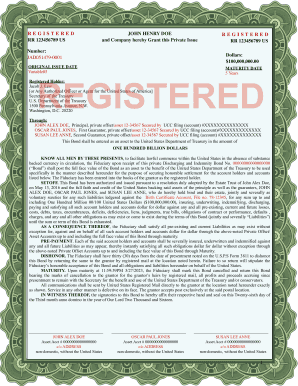

Secured Party Creditor ID Card Application free printable template

Show details

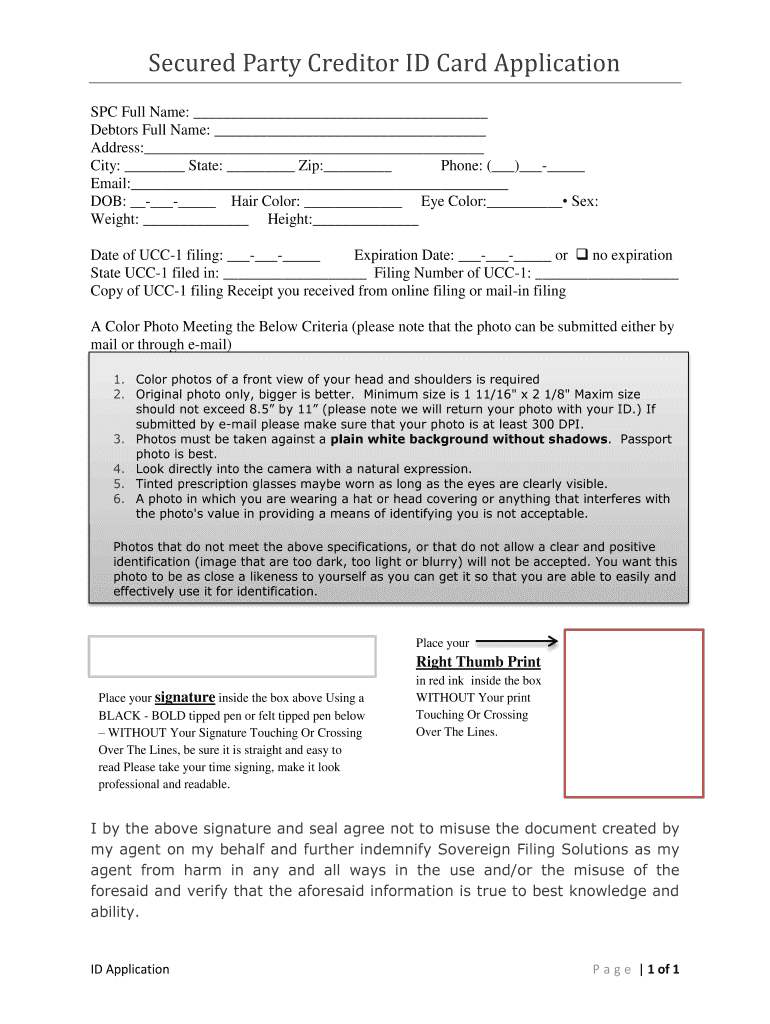

Secured Party Creditor ID Card Application SPC Full Name Debtors Full Name Address City State Zip Phone - Email DOB -- Hair Color Eye Color Sex Weight Height Date of UCC-1 filing -- Expiration Date -- or no expiration State UCC-1 filed in Filing Number of UCC-1 Copy of UCC-1 filing Receipt you received from online filing or mail-in filing A Color Photo Meeting the Below Criteria please note that the photo can be submitted either by mail or through e-mail 1. Color photos of a front view of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign become secured party creditor form

Edit your secured party creditor step by step form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secured party creditor package pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing secured party creditor online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit how to become a secured party creditor form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secured party creditor guide form

How to fill out Secured Party Creditor ID Card Application

01

Gather necessary personal information such as your name, address, and contact details.

02

Obtain the Secured Party Creditor ID Card Application form from the appropriate authority or website.

03

Fill in your personal information accurately on the application form.

04

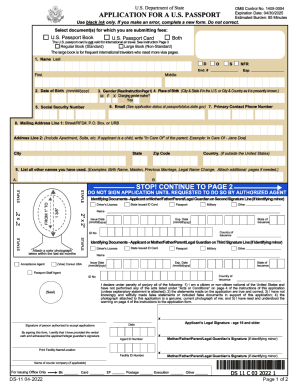

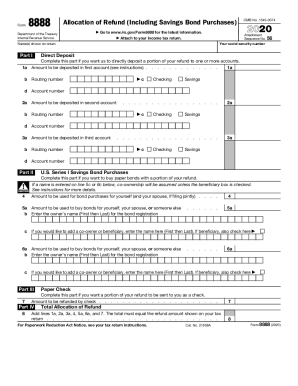

Provide any proofs or documentation required to support your application, such as identification or financial records.

05

Review the completed application for any errors or missing information.

06

Submit the application, along with any required fees, to the designated office or online portal.

07

Wait for confirmation and processing of your application from the relevant authority.

Who needs Secured Party Creditor ID Card Application?

01

Individuals or businesses seeking to establish themselves as secured parties in a transaction.

02

Anyone looking to protect their interests in collateral or gain legal recognition for their creditor status.

03

Those involved in financial or legal agreements that require formal identification as a secured party.

Fill

secured party creditor form

: Try Risk Free

People Also Ask about secured party creditor package

How does one become a secured party creditor?

In order to become a secured party, one must (i) prepare a document which grants a security interest (which is the agreement between the parties) and (ii) also perfect on that security interest (which is the notice to the world of the security interest). Without both steps occurring, the lender will be unsecured.

What are the advantages of being a secured creditor?

Secured personal loans generally have lower interest rates because they are backed by collateral (and thus pose a lower risk for the lenders). This typically results in lower interest rates for the consumer. Secured creditors are given priority over junior creditors if an institutional borrower becomes insolvent.

Who is a secured party?

A secured party in UCC law is a person who has the favor of the security interest that is created or provided for under a security agreement, whether or not there is an obligation to be secured that is outstanding.

What does it mean to be a secured party creditor?

What makes someone a secured party? To put it in simple terms, the secured party is the creditor on the UCC loan. The creditor is the secured party because they have a financial interest in the collateral which the lien is on.

What makes someone a secured creditor?

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

Who is the secured party in a security agreement?

“Secured party” is defined as the person in whose favor the security interest is granted (§9-102(a)(72)(A)).

What are the benefits of being a secured party creditor?

Secured personal loans generally have lower interest rates because they are backed by collateral (and thus pose a lower risk for the lenders). This typically results in lower interest rates for the consumer. Secured creditors are given priority over junior creditors if an institutional borrower becomes insolvent.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send how to become a secured party creditor pdf for eSignature?

Once you are ready to share your secured party creditor documents, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find secured party creditor process?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the secured party creditor id. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out secured party creditor forms pdf on an Android device?

Complete your secured party creditor form pdf and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is Secured Party Creditor ID Card Application?

The Secured Party Creditor ID Card Application is a form used by individuals or entities to establish their status as a secured party creditor, allowing them to claim certain rights and benefits under secured transactions law.

Who is required to file Secured Party Creditor ID Card Application?

Individuals or entities involved in secured transactions, particularly those seeking to obtain or enforce security interests, are required to file the Secured Party Creditor ID Card Application.

How to fill out Secured Party Creditor ID Card Application?

To fill out the Secured Party Creditor ID Card Application, you must provide accurate personal or business identification information, describe the secured transaction details, and ensure any required documentation is attached before submission.

What is the purpose of Secured Party Creditor ID Card Application?

The purpose of the Secured Party Creditor ID Card Application is to formally identify secured parties in financial transactions, enabling them to exercise their rights and claims against the collateral in case of default.

What information must be reported on Secured Party Creditor ID Card Application?

The Secured Party Creditor ID Card Application must report the name and contact information of the applicant, details of the secured transaction, the nature of the collateral, and any applicable jurisdictional information.

Fill out your Secured Party Creditor ID Card Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secured Party Creditor Guide Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to becoming a secured party creditor

Related to how to become a secure party creditor

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.